Dual Key Home Designs: Maximising Your Investment in Perth

Damon Stroud

When it comes to property investment in Perth, dual key home designs offer a unique opportunity to generate a positive cash flow while also building capital for future investments. Leading experts in Australia's property market have long recommended this strategy for investors who want to maximise their returns without taking on excessive risk.

Understanding Dual Key Home Designs

Dual key home designs are innovative housing solutions that allow investors to generate two rental incomes from a single property. Essentially, this design consists of two separate living spaces within one dwelling—often with shared entrances and amenities—providing the flexibility to rent out both units independently.

In the context of property investment, dual key homes are particularly appealing because they offer the ability to generate higher rental yields compared to traditional single-dwelling investments. This makes them an ideal choice for those looking to create an ongoing income stream while also benefiting from potential capital growth.

The Strategy: Dual Key Investment to Subsidise Blue Chip Losses

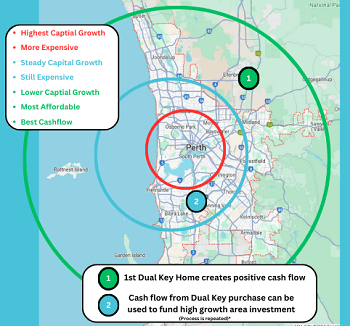

In Perth’s current property market, purchasing a home in a blue-chip suburb like Sorrento W.A can be an attractive option due to the potential for significant capital growth. However, the high cost of these properties often results in negative cash flow, as the rental income typically does not cover the mortgage repayments.

This is where a dual key home investment can play a crucial role. By investing in a dual key property—typically located in more affordable outer suburbs—you can generate a positive cash flow. The income from this investment can then be used to subsidise the losses from your blue-chip property, balancing your overall portfolio.

This strategy allows you to take advantage of the long-term capital growth potential of a blue-chip suburb while mitigating the short-term financial burden with the positive cash flow from your dual key investment.

The Economics of Dual Key Homes in Perth

Dual key homes are generally built in outskirt areas of Perth, where property prices are more accessible. While these areas might not experience the same rapid capital growth as premium blue-chip suburbs, the initial lower investment cost and the potential for higher rental yields make them a practical and safer choice for investors.

Moreover, with the current housing shortage in Perth, there’s been a noticeable shift in rental patterns. Many property owners are now renting out individual rooms to single tenants, a trend that has significantly increased rental income. In fact, some dual key investments are now seeing up to 40% additional income due to this change.

This trend further strengthens the argument for investing in dual key homes, as it offers the potential for even greater returns in the current market climate.

The Risks and Considerations

While the benefits of dual key home designs are clear, it's important to be aware of the potential risks and challenges associated with this investment strategy.

Location: As dual key properties are often located in outskirt areas, they might not appreciate in value as quickly as properties in blue-chip suburbs. This means that while you might enjoy higher rental yields, the long-term capital growth could be slower.

Market Demand: The success of a dual key investment largely depends on the rental demand in the area. If the demand decreases, you might struggle to find tenants for both units, which could impact your rental income.

Maintenance and Management: Managing a dual key property can be more complex than a traditional investment, particularly if you have different tenants in each unit. This could result in higher management and maintenance costs.

Despite these considerations, many investors find that the pros outweigh the cons, especially when the goal is to generate a steady cash flow and reduce financial pressure from more expensive properties in blue-chip areas.

Expert Insights on Dual Key Investments

According to property experts, dual key homes represent a smart investment strategy for those looking to diversify their portfolios and manage risk. The combination of higher rental yields and lower initial investment costs make them an attractive option in Perth’s current market.

A well-known property research firm notes that while the outer suburbs of Perth may not match the capital growth rates of blue-chip areas, they offer consistent rental demand and a growing population base. This makes dual key properties in these regions a reliable source of income over the long term. As an example the North East corridor of Perth is projected to be Perth,s fasted growing area.

Moreover, the trend towards renting out rooms to single tenants, as seen in the current Perth market, is likely to continue, further enhancing the income potential of dual key homes.

Practical Steps for Potential Investors

If you’re considering investing in a dual key home design, here are some practical steps to help you get started:

Research the Market: Understand the current trends in Perth’s property market, particularly in the outer suburbs where dual key homes are typically located. Look for areas with strong rental demand and potential for steady growth.

Work with Experts: Engage with a reputable real estate agent who specialises in dual key properties. They can provide valuable insights and help you find the right investment to match your goals.

Assess the Financials: Calculate the potential rental income and compare it to your expected mortgage repayments and other costs. Ensure that the property will generate a positive cash flow before making a commitment.

Plan for the Long Term: Consider how this investment fits into your overall property portfolio. Dual key homes are often best suited as part of a broader investment strategy that includes properties in both high-growth and high-yield areas.

High-Authority Insights on Property Investment

For further reading on property investment strategies, consider these high-authority sources:

CoreLogic’s Australian Housing Market Update: Provides detailed analysis and insights into the current trends in the Australian property market, including rental yields and capital growth projections.

Real Estate Institute of Australia (REIA): Offers comprehensive resources and expert opinions on property investment in Australia, including the benefits and challenges of dual key home designs.

The Australian Financial Review: Regularly publishes articles and reports on the latest developments in the property market, offering valuable information for investors looking to maximise their returns.

To Sum Up

Dual key home designs are a powerful tool for investors looking to maximise their returns in Perth's property market. By providing two rental incomes from a single property, they offer a unique opportunity to generate positive cash flow and subsidise the costs of higher-priced investments in blue-chip suburbs.

While dual key homes are typically located in outskirt areas with slower capital growth, the current trend towards renting rooms to single tenants is enhancing their income potential. This makes them a compelling option for those looking to build a diversified and resilient property portfolio.

As with any investment, it’s important to do thorough research and seek professional advice before making a decision. With the right approach, a dual key investment could be a significant step towards achieving your financial goals.

FAQs

How does a dual key investment work in Perth?

In Perth, dual key investments are typically made in more affordable outer suburbs. The rental income from these properties can be used to offset the losses from more expensive investments in blue-chip areas, creating a balanced and profitable portfolio.

Are there risks associated with dual key home investments?

Yes, while dual key homes offer high rental yields, they are often located in areas with slower capital growth. Additionally, managing a dual key property can be more complex and costly than a traditional investment. It’s important to consider these factors and seek professional advice before investing.

Disclaimer: Always seek professional advice from a licensed financial planner or accountant before making any investment decisions.